the tax team llc

Schedule K-1 reports the members share of LLC income deduction and tax credit items. Inheritance tax is different than estate as it is based upon who is in receipt of the property rather than on the total amount or value of the property.

Let the most trusted tax.

. Closer relatives and charities are exempt from the inheritance tax and other inheritors may pay an inheritance tax rate of 10. Partnership Return of Income. When forming a business one of the most important decisions you have to make particularly from a tax perspective is how youll classify your companyFor the smallest operations this might be a sole proprietorship but more often the choice is between forming an LLC and a C Corp each of which has its own filing norms tax rules and regulations.

These amounts are then included on the members personal tax return. We want to be part of your financial team. Our team of experts possess the skills and knowledge to help you make better financial decisions and generate wealth.

We use the most advanced systems to provide you with the most reliable secure and timely information so you can make the best decisions possible. We also provide tax services in the area of salesuse tax and income tax. We are amongst most renowned consultancies for accounting outsourcing companies in UAE consisting a team of finest auditors and Business consultants that keeps reliable up to date data of financial statements helping you to coordinate well with laws.

Contact Summit Tax Accounting LLC to start building a strong financial foundation for your personal business or non-profit organization. If you need immediate relief from IRS collections call us today. You are drawing from a focused team with years of experience in your industry.

2022 Askey Askey Associates CPA LLC All Rights Reserved. And we are the FTA Certified Accounting Firm in Dubai and FTA Registered Vat Consultants providing excellant. On January 1 1990 STR was incorporated to form an autonomous company following ten years as an integral part of.

Tax division in 1980 as a delinquent tax collection service. Get IRS tax relief from the team more people trust. Meaning your LLC was formed between December 17th and December 31st.

Welcome to TaxBiz - the ONLY place dedicated to learning how to start scale and operate a 100 digital tax business. Our staff of over 50 professionals has extensive experience in this specialized area of tax. Inheritance Tax Exemptions.

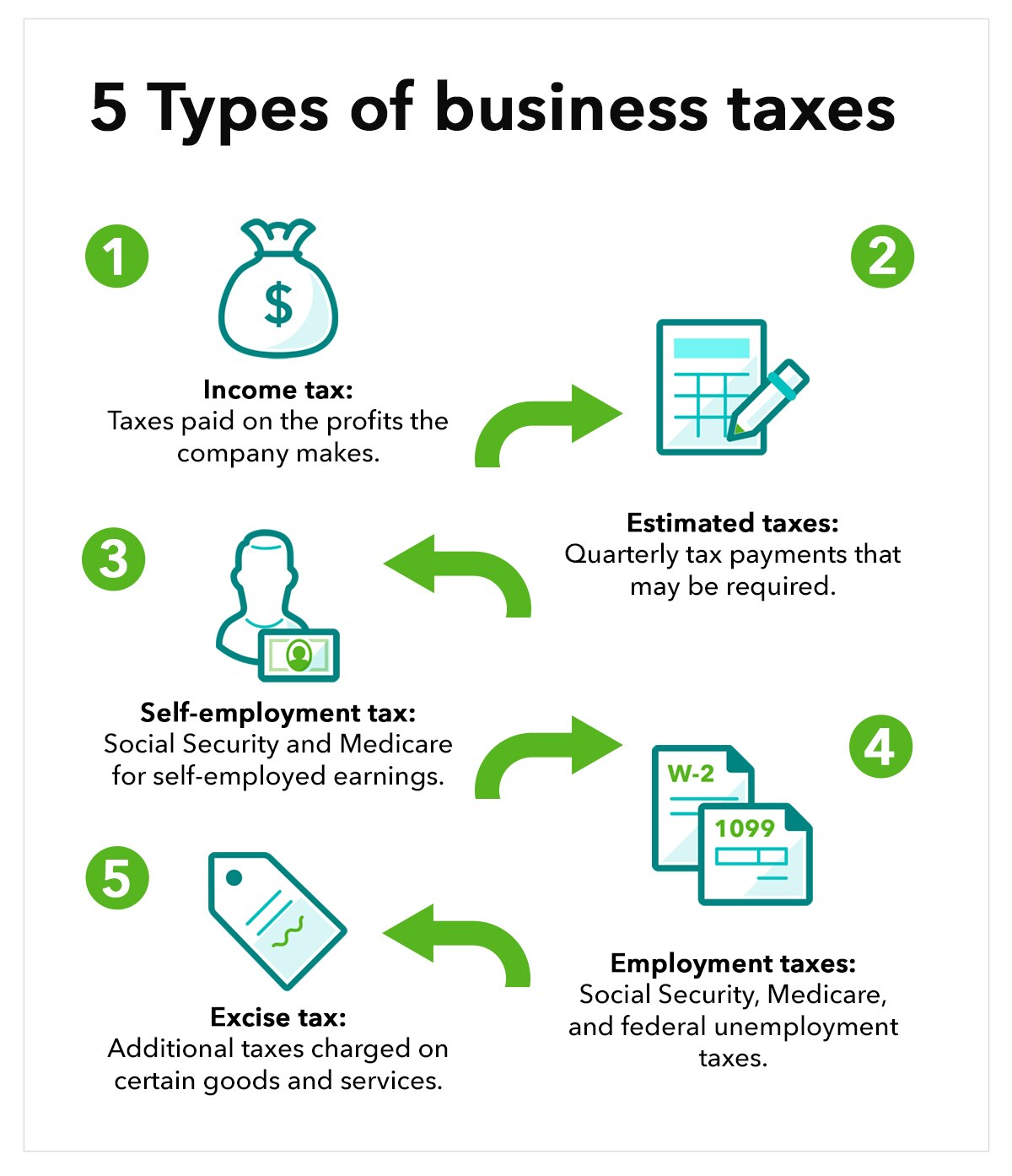

What We Do Tax Advisory Services Group LLC is a full-service excise tax provider. Statewide Tax Recovery LLC STR began as a branch of Central Credit Audit Inc. When you engage Dentons for tax services youre getting an interdisciplinary team that understands how tax law meshes with other areas of the lawcorporate real estate and litigation to name a few.

Hey Homer you just made it You dont have to pay an 800 fee for the 2016 tax year therefore avoiding the dreaded back-to-back 800 Annual Franchise Tax paymentsThe reason why is that you fall within the 15-day rule. The annual Form 1065 must also include a Schedule K-1 for each member. Youll get affordable transparent pricing and a clear plan for the best possible tax debt settlement.

So at tax time to keep the IRS happy an LLC files Form 1065. Join Us As We Go Digital. We work closely with our clients and enjoy a reputation for providing.

Radke Mohrhauser LLC will provide the highest quality tax consulting tax preparation accounting and payroll services in the area.

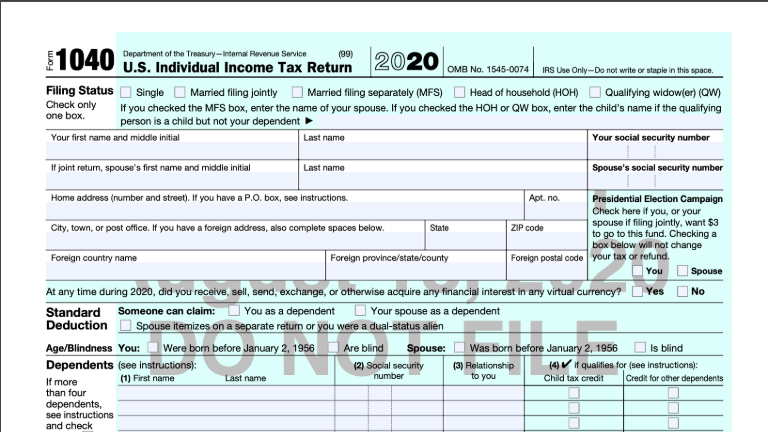

Tax Year 2020 Changes To Irs Form 1040 Taxslayer Pro S Blog For Professional Tax Preparers

What Is Schedule C Tax Form Form 1040

How Much Does A Small Business Pay In Taxes

Everything You Need To Know About The 2021 Tax Deadlines Forbes Advisor

Tax Classifications For Llc Everything You Need To Know

These Credit Cards Are Offering Tax Service Savings To Help You Save Money When Filing This Year Nextadvisor With Time

Small Business Tax Prep Checklist What Business Owners Should Know Article

Should I Do My Own Taxes Or Hire An Accountant Use A Chart To Decide

State Corporate Income Tax Rates And Brackets Tax Foundation

It S Never Too Early To Start Business Tax Tax Preparation Tax Quote

:max_bytes(150000):strip_icc()/JacksonHewitt-5debaef1f9b54a8a89f0847de5389a27.jpg)

The 5 Best Tax Preparation Services Of 2022

How To File An Extension For Taxes Form 4868 H R Block

/dotdash_Final_Paying_Social_Security_v1_Taxes_on_Earnings_After_Full_Retirement_Age_Oct_2020-01-ec61e06a655442e9926572d10bb7d993.jpg)

Paying Social Security Taxes On Earnings After Full Retirement Age